Medical insurance in india pdf

Medical insurance in india pdf

144 The condition of the health insurance in India is pathetic. A huge part of Indian population does not use health Insurance to finance their medial

Medical Insurance in India. Introduction to Medical Insurance. India is the most preferred medical tourism destination in the world. The increasing cost of medical insurance every year is meant especially for those people who pay for individual health insurance policies.

• In 2015, crop insurance market in India is the largest in the world and covers around 32 million farmers; which accounted for nearly 19 per cent of the total farmers in the country • Strong growth in the automotive industry over the next decade to be a key driver of motor

India, IRDA – Insurance Regulatory and Development Authority • The life insurance sector was made up of 154 domestic life insurers, 16 foreign life insurers and 75 provident funds • All life insurance companies were nationalized to form LIC in 1956 to increase penetration and protect policy holders from mismanagement • The non-life insurance business was nationalized to form GIC in 1972

Types of health insurance plans: There are 4 types of health insurance plans available in India: Mediclaim: It is the most common and basic health insurance policy available in the market. It provides reimbursement for all medical expenses incurred by the life insured during the period of hospitalisation.

In the case any form of health insurance coverage in India, only 11% of the country’s populations have access to insurance policies (Sharawat and Rao, 2011). In India where majority of the curative health …

A brief background • A New health insurance company in India • A new product is identified by Chief Marketing Officer • It has a good business opportunity

indian insurance. bigger, better, faster. 2 the changing face of indian insurance 4 foreword 5 the changing face of indian insurance 14 mega trends in indian insurance industry 17 indian general insurance—gearing up for new age trends 20 indian life insurance—the journey so far and the way ahead 22 digital revolution in the general insurance industry 25 indian insurance in 2020—targeting

payment of health insurance premium and expenditure on medical treatment. Deduction in respect of Life Insurance Premium, PPF, NSC, etc. [Section 80C] Section 80C provides deduction in respect of various items like life insurance premium,

Microinsurance: Demand and Market Prospects – India Allianz AG fields of property and casualty insurance, life and health insurance, asset management and banking.

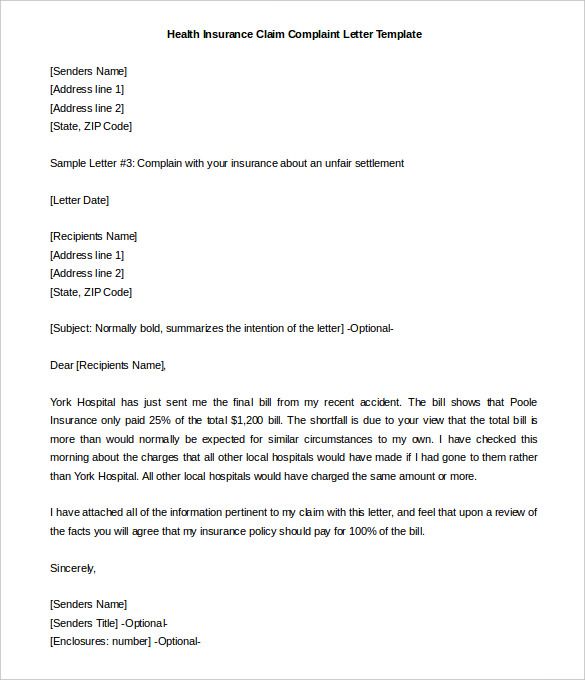

More than 75% of all payments on medical treatment in India are made by patients themselves. The idea of health insurances is relatively new to India and only 10% of Indians are covered. Insurance policies can be very confusing, leaving much of their coverage unclear.

Desired strategies and ways of furthering the role of the Insurance Regulatory and Development Authority in acting as a regulator for the purpose of ensuring the industry’s smooth functioning is an issue for India’s health services.

Case Study Health Insurance New product

TAX BENEFITS DUE TO LIFE INSURANCE POLICY HEALTH

The primary regulator for insurance in India is the Insurance Regulatory and Development Authority of India (IRDAI) which was established in 1999 under the government legislation called the Insurance Regulatory and Development Authority Act, 1999.

Health insurance plans by Religare – A range of best health insurance policies in India which are tailored to fit every individual’s life perfectly & feasibly. Key Features – Cashless Claims, 5420 + Hospitals Coverage, 30 Day Pre-Hospitalization Coverage, Automatic Recharge of Sum Insured etc.

India Profile » Medical Tourism In India » Medical Insurance India Medical Insurance India Medical Tourism to India has grown over the years, as people all over the world gain greater awareness of the world-class standards of health care available in India, at very reasonable prices.

Medindia’s Health Insurance section offers valuable information about health insurance and also lists some of the insurance companies that provide you with a good insurance cover.

PRIVATE HEALTH INSURANCE IN AUSTRALIA: A CASE STUDY Introduction 9. Among the countries with large private health coverage, Australia is a fascinating case. Large interactions exist between public and private coverage systems. These are the result of government approaches to financing health care, which have largely linked private health insurance (PHI) to the private hospital system, so that

Private health insurance has historically been characterised as voluntary, for-profit commercial coverage. However, in looking at private coverage around the world, it is evident that a wide variety of arrangements are described under the umbrella of private

Indian healthcare has taken leaps in terms of becoming a medical tourism destination, the delivery system both public and private, continues to remain elusive to …

Medical insurance Government hospitals –It includes healthcare centres, district hospitals and general hospitals It includes manufacturing, extraction, processing, purification and packaging of chemical materials foruse as medications humans or animals It comprises businesses and laboratories that offer analytical or diagnostic services, including body fluid analysis It includes

medical insurance that covers your medical expenses. While you may be covered by While you may be covered by someone else’s insurance now, you will soon be in a position to make your own

also have come up with their own insurance schemes. Despite these initiatives, the actual public spending on health has not shown much increase. This chapter analyzes public spending on health care in India. The second section presents the salient features of the health care system in India and the health status of the population. The third section examines the impact of low levels of public

Int J Health Care Finance Econ DOI 10.1007/s10754-012-9110-5 State health insurance and out-of-pocket health expenditures in Andhra Pradesh, India

Insurance for the Poor in India” on 17th March, 2003. This revised paper incorporates This revised paper incorporates comments made by the workshop participants.

Health Insurance. Health insurance is basically an insurance policy that allows a person to deal with medical contingencies of future. It offers the require financial cover to the insured to deal with medical expenses associated with the treatment, hospitalization, etc.

The main factor contributing to rising medical tourism in India is presence of a well-educated, English-speaking medical staff in state-of-the art private hospitals and diagnostic facilities Shares in healthcare spending in India, 2015

For long-term and comprehensive major medical cover, an “Expat Plan” or global medical insurance will cover you in India and throughout the world. These plans offer comprehensive coverage and are annually renewable, often available to cover you for the rest of your life.

cannot be denied, it is unfortunate that so far in India the Health Insurance policy is being purchased by families and individuals who can afford to pay the medical bills. But the Govt. of India is putting all its efforts to encourage people to buy health insurance and specialized insurance companies are promoted which are exclusively dealing in health insurance. The life insurance companies

i Foreword The paper “Health Insurance for the Poor in India” was prepared to give an overview on the topic. Earlier draft of the paper was presented at ICRIER in a workshop

With India’s medical costs surging tremendously, it is time we gave health insurance its due importance. Furthermore, the kind of lifestyle that people have started to lead these days causes additional health problems and that in turn increases expenditure on medical bills and treatment.

Pulyapudi Srinivas Research scholar & Advocate, Visakhapatnam Abstract: The patients who joined in Hospitals or approaches medical professionals for treatment are faced with many problems and the said problems are identified as many as 25 in numbers as mentioned at page 3 of this article. Further through this article the research scholar is trying to find out solutions to eradicate this menace

Get medical insurance quotes, buy and claim your medical insurance policy, all online. No two persons are the same, so why should your health insurance be the same. You’ll find plans crafted looking at your health needs, family size, age, and a host of other features.The best health insurance plans in India are coming very soon to you—and they won’t just cover hospitalization. You’ll

According to world health organisation India have 112 ranking in health all over the world. So we can say that we have needed the health insurance cover to protect our health expenses. Health problem is an unexpected problem so we need the health plan to protect our health expenditure. There are some other benefits of having health policy like free preventive care, vaccination, screening, and

Definition “Health insurance, like other forms of insurance, is a form of collectivism by means of which people collectively pool their risk, in this case the risk of incurring medical expenses.” 5.

A medical insurance considered essential in managing risk in health. Anyone can be a victim of critical illness unexpectedly. And rising medical expense is of great concern. Medical Insurance is one of the insurance policies that cater for different type of health risks. The insured gets a medical support in case of medical insurance policy.

Impact of Medical Mal-Practice in India

– medical release form template pdf

State health insurance and out-of-pocket health

India Health Insurance Safety and Medical Advice

Health insurance SlideShare

Medical Insurance India Medical Treatment & Legal

Health Insurance in India Just Landed

WHO GETS HEALTH INSURANCE COVERAGE IN INDIA? IUSSP

–

Health insurance SlideShare

India Health Insurance Safety and Medical Advice

Health insurance plans by Religare – A range of best health insurance policies in India which are tailored to fit every individual’s life perfectly & feasibly. Key Features – Cashless Claims, 5420 Hospitals Coverage, 30 Day Pre-Hospitalization Coverage, Automatic Recharge of Sum Insured etc.

The primary regulator for insurance in India is the Insurance Regulatory and Development Authority of India (IRDAI) which was established in 1999 under the government legislation called the Insurance Regulatory and Development Authority Act, 1999.

i Foreword The paper “Health Insurance for the Poor in India” was prepared to give an overview on the topic. Earlier draft of the paper was presented at ICRIER in a workshop

Definition “Health insurance, like other forms of insurance, is a form of collectivism by means of which people collectively pool their risk, in this case the risk of incurring medical expenses.” 5.

Private health insurance has historically been characterised as voluntary, for-profit commercial coverage. However, in looking at private coverage around the world, it is evident that a wide variety of arrangements are described under the umbrella of private

payment of health insurance premium and expenditure on medical treatment. Deduction in respect of Life Insurance Premium, PPF, NSC, etc. [Section 80C] Section 80C provides deduction in respect of various items like life insurance premium,

indian insurance. bigger, better, faster. 2 the changing face of indian insurance 4 foreword 5 the changing face of indian insurance 14 mega trends in indian insurance industry 17 indian general insurance—gearing up for new age trends 20 indian life insurance—the journey so far and the way ahead 22 digital revolution in the general insurance industry 25 indian insurance in 2020—targeting

Indian healthcare has taken leaps in terms of becoming a medical tourism destination, the delivery system both public and private, continues to remain elusive to …

Microinsurance: Demand and Market Prospects – India Allianz AG fields of property and casualty insurance, life and health insurance, asset management and banking.

For long-term and comprehensive major medical cover, an “Expat Plan” or global medical insurance will cover you in India and throughout the world. These plans offer comprehensive coverage and are annually renewable, often available to cover you for the rest of your life.

A brief background • A New health insurance company in India • A new product is identified by Chief Marketing Officer • It has a good business opportunity

Medical Insurance in India. Introduction to Medical Insurance. India is the most preferred medical tourism destination in the world. The increasing cost of medical insurance every year is meant especially for those people who pay for individual health insurance policies.